Choosing the right moment to begin your trading week is a big deal for many who follow the Inner Circle Trader (ICT) concepts. The question of whether the weekly open should be at 9:30 AM ICT or midnight ICT is something that really shapes your trading approach, you know? It's a key decision for anyone serious about their market journey, and it can feel like a rather important crossroads.

This timing isn't just a simple clock setting; it has a deep impact on your market analysis, how you set up your strategies, and even your mental state during the trading week. The very start of the week can often hint at the overall market tone, so picking the right time to observe it is quite significant, that. It's about finding a rhythm that works for you and the market.

There's a good bit of discussion around these two distinct open times, and each has its own set of advantages and challenges. We'll look at why each option has its fans, considering the various angles that might influence your choice. Ultimately, figuring out what's best for you means weighing different factors, and we'll explore those here, too.

Table of Contents

- The Core Debate: 9:30 AM ICT vs. Midnight ICT

- Why Does the Weekly Open Matter in ICT Trading?

- Factors to Consider When Choosing Your Open Time

- Practical Tips for Both Approaches

- FAQs About Weekly Open Times

- Making Your Decision: A Personalized Approach

The Core Debate: 9:30 AM ICT vs. Midnight ICT

The choice between a midnight ICT open and a 9:30 AM ICT open is a central point of discussion among traders who follow the ICT framework. Each time represents a different perspective on when the "true" weekly market activity begins, and honestly, both have their strong points. It's not just about when the charts update; it's about what market forces are at play.

Some traders feel very strongly that one time is superior to the other, while others find success by adapting to both or choosing based on specific market conditions. This really boils down to how you perceive market structure and liquidity, that. It’s a pretty nuanced discussion, actually, and understanding both sides helps you make a more informed choice.

Understanding Midnight ICT Open

The midnight ICT open happens when the new weekly candle officially starts on most trading platforms, typically Sunday evening in New York time, which translates to Monday midnight ICT (New York time). For many, this moment represents the absolute earliest start to the trading week, you know? It’s when the market truly resets from the previous week's close.

One of the main advantages of focusing on this open is the chance to capture early moves that might set the tone for the entire week. Some traders believe that the very first few hours after midnight ICT can offer important clues about institutional positioning or a general direction, so. It gives you a complete picture of the weekly candle from its absolute beginning, arguably.

However, trading around midnight ICT can come with its own set of challenges. Liquidity tends to be much lower during these hours, especially before the Asian session gets into full swing. This can lead to wider spreads and potentially less predictable price action, which is a bit tricky, especially for newer traders. There's also the matter of time zones; for many, midnight ICT means late nights or very early mornings, which can mess with your sleep, that.

The market can be rather quiet and prone to sudden, sharp movements on low volume, sometimes called "whipsaws," that can be difficult to manage. You might see price move quickly in one direction only to reverse just as fast, which can be frustrating. So, while it offers a pure look at the weekly start, it also demands a good deal of patience and careful risk management, you know?

The Case for 9:30 AM ICT Open

The 9:30 AM ICT open aligns with the New York stock market opening bell, a time when a significant amount of institutional money and retail trading activity really wakes up. This period, often occurring after the London session has been active for a few hours, is characterized by a surge in liquidity and generally more robust price action, that. Many traders feel this is when the "real" trading week truly begins for major pairs and indices.

A big benefit of waiting for the 9:30 AM ICT open is the higher liquidity, which often means tighter spreads and smoother price movements. This can make entries and exits more precise and reduce the risk of unexpected volatility from thin markets, so. It also aligns with traditional working hours for many, making it easier to manage a trading schedule without sacrificing sleep, arguably.

Traders who prefer this open often look for specific setups that tend to form as major market participants enter the fray. The price action tends to be more directional and less prone to the erratic moves sometimes seen in the quieter midnight hours. You might find more reliable trends and clearer confirmations during this period, which can be quite reassuring, you know?

On the flip side, waiting until 9:30 AM ICT means you might miss out on moves that happen during the Asian or early London sessions. Sometimes, the market will establish a significant direction or fill a gap created at the midnight open before New York even wakes up. This means you might feel like you're playing catch-up a little, in a way, or entering a move that's already well underway. It’s a trade-off between early insight and higher liquidity, basically.

Why Does the Weekly Open Matter in ICT Trading?

For those who follow ICT principles, the weekly open is more than just a timestamp; it's a critical moment for market analysis and strategy formation. The initial price action of the week can often provide valuable clues about the market's overall sentiment and potential direction for the days ahead, you know? It’s like the opening scene of a play, setting the stage for what’s to come.

Understanding the significance of this moment helps traders anticipate moves and position themselves effectively. It's about getting a feel for the market's pulse right from the start, that. This early insight can be a powerful tool, especially when combined with other ICT concepts, so.

Liquidity and Volatility at the Open

The amount of money flowing into the market, known as liquidity, and how much prices jump around, or volatility, are very different at various times of the day, and especially at the weekly open. Midnight ICT, for instance, often sees lower liquidity because many major financial centers are still asleep or just waking up. This can make the market feel a bit thin, you know?

Lower liquidity can lead to higher volatility in some ways, as smaller orders can have a bigger impact on price. It's like trying to steer a small boat in calm waters versus a large ship in a busy harbor; the small boat reacts more sharply to a gentle push. This means prices might move quite erratically, making it harder to find clean entries or exits, arguably.

In contrast, the 9:30 AM ICT open brings with it a massive surge in liquidity as New York institutions begin their day. This influx of capital tends to stabilize price action, making moves more predictable and less prone to sudden, unexpected swings. It’s when the big players really start to move the market, that. You often see more sustained trends and clearer reactions to key levels.

The difference in liquidity and volatility at these two times means that a strategy that works well at one open might not be suitable for the other. A trader looking for big, fast moves might prefer the potential volatility of the midnight open, while someone seeking smoother, more reliable trends might wait for 9:30 AM ICT. It really changes the game, it's almost, and understanding this is quite important.

Setting the Weekly Bias

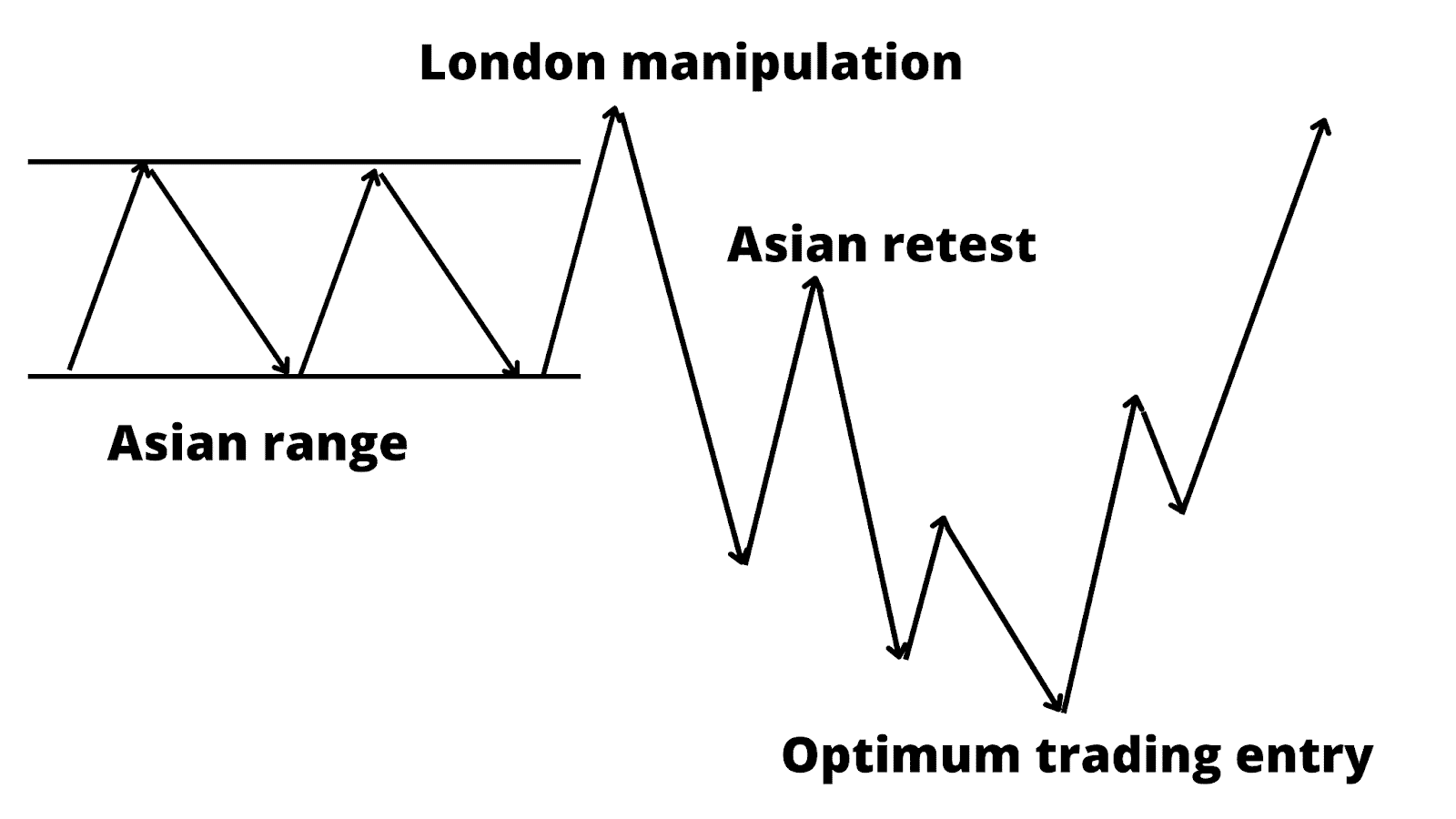

In ICT trading, setting a "weekly bias" is a core idea. This means trying to figure out the likely direction the market will take over the entire week – whether it's likely to go up, down, or stay within a certain range. The very first few hours or even minutes after the weekly open can give you a lot of clues about this, so.

Traders often watch how price reacts to key levels, previous week's highs or lows, or specific price action patterns right at the open. For example, if the market strongly rejects a certain level right at midnight ICT, it might suggest a bearish bias for the week ahead. This early indication helps shape the trades you might look for throughout the week, you know?

Similarly, the price action around the 9:30 AM ICT open can also provide strong signals for the weekly bias. The institutional flow that enters the market at this time often confirms or contradicts the earlier midnight moves. If big money starts pushing price in a clear direction, it can reinforce a bias or even establish a new one, that.

The weekly open is essentially a canvas where the market begins to paint its intentions. Observing how these initial brushstrokes are made, whether at midnight or later in the morning, helps traders anticipate the broader picture. It’s about trying to get ahead of the curve, or at least understand which way the market is leaning, arguably, which is a key part of successful trading.

Factors to Consider When Choosing Your Open Time

Deciding between the 9:30 AM ICT or midnight ICT weekly open isn't a one-size-fits-all situation. What works well for one trader might not be the best fit for another, and there are several personal and market-related factors that really come into play. It's about finding what "should" be your preferred approach, what is "desirable" for your unique situation, you know?

Thinking about these elements carefully can help you make a choice that supports your trading goals and your overall well-being. This is a big one, honestly, because your trading needs to fit into your life, not the other way around. It’s pretty important to consider all angles, that.

Personal Schedule and Lifestyle

Your daily routine and personal commitments are perhaps the most important factors when deciding on your weekly open time. If you have a day job or family responsibilities that make it impossible to be awake and focused at midnight ICT, then forcing yourself to trade at that time is probably not a good idea, you know?

Trading while tired or distracted can lead to poor decision-making, increased stress, and ultimately, losses. It's just not worth it, honestly. You have to make sure your trading schedule supports a healthy lifestyle, not detracts from it, so. A well-rested mind is a sharp mind, and that's what you need for consistent trading.

On the other hand, if your schedule allows for it, and you're a night owl, the midnight ICT open might fit perfectly into your routine. Perhaps you work evenings and have free time when the markets are quieter. In that case, it could be a very natural fit for you, that. It's all about what works with your life, basically.

Similarly, if you're an early bird or have a typical 9-to-5 job, the 9:30 AM ICT open might be much more manageable. You can get a good night's sleep, start your day, and then focus on the markets when they are most active during New York session hours. This kind of alignment can reduce stress and make trading feel less like a chore and more like a focused activity, arguably. Consider your sleep patterns, your energy levels, and any other commitments that might affect your ability to trade effectively.

Market Conditions and Asset Classes

Different market conditions and the specific assets you trade can also influence which weekly open time is more suitable. Some assets, like major currency pairs, might show clearer patterns at midnight ICT due to early Asian session activity. Others, like stock indices, really wake up around the 9:30 AM NYC open, that.

For example, if you primarily trade the S&P 500 or Nasdaq, waiting for the New York session open at 9:30 AM ICT is often more beneficial because that's when the most significant volume and institutional participation occur for those instruments. Trying to trade them at midnight ICT might mean dealing with very low liquidity and choppy price action, which can be a bit frustrating, you know?

Conversely, if you focus on currency pairs involving the Japanese Yen or Australian Dollar, the Asian session, which begins shortly after midnight ICT, might offer more opportunities. These pairs often become more active as Tokyo and Sydney come online, so. Understanding which assets are most active at certain times is pretty important for choosing your open.

Also, consider the overall market environment. In highly volatile periods, the midnight open might be too unpredictable for some, while in calmer times, it might offer subtle clues that are missed later. Adapting your preferred open time based on current market conditions can be a smart move, basically. It's not always a fixed choice, but rather something you might adjust over time, arguably.

Psychological Impact

The mental and emotional toll of trading at certain times cannot be overstated. Trading is already a demanding activity, and adding sleep deprivation or constant stress from an inconvenient schedule can severely impact your performance. If you're constantly fighting fatigue to catch the midnight open, your decision-making will suffer, you know?

Being fresh and alert is absolutely key to making good trading decisions. When you're tired, you're more prone to emotional trading, chasing trades, or missing important signals. This can lead to costly mistakes and a cycle of frustration, so. It’s about being in the right headspace, that.

Conversely, choosing an open time that aligns with your natural rhythm and allows for adequate rest can significantly improve your focus and discipline. When you feel good, you tend to stick to your plan, manage risk better, and approach the market with a clearer mind. This psychological edge is something many successful traders value highly, arguably.

Consider how each open time makes you feel. Does the idea of trading at midnight fill you with dread, or does it feel like a quiet, focused time? Does waiting until 9:30 AM make you feel impatient, or does it give you a sense of calm and preparation? Your emotional comfort with the timing is a very real factor in your long-term trading success, basically. It's not just about the numbers; it's about your well-being, too.

Practical Tips for Both Approaches

No matter which weekly open time you lean towards, there are some practical steps you can take to make the most of it. These tips are about refining your approach and ensuring you're prepared for the specific characteristics of each period. It's about being smart with your time and energy, you know?

Whether you're an early bird or a night owl, having a clear plan for how you'll engage with the market at your chosen open time is pretty important, that. These suggestions can help

Detail Author:

- Name : Wilfred Skiles

- Username : emilia08

- Email : hudson.hattie@gmail.com

- Birthdate : 1971-11-05

- Address : 266 Koelpin Springs Apt. 075 North Eveline, NY 13084

- Phone : 405.689.4956

- Company : Rau Inc

- Job : Timing Device Assemblers

- Bio : Maxime est tempora molestiae adipisci saepe. Necessitatibus laudantium incidunt earum consequatur amet assumenda ducimus. Accusamus qui commodi sint. Et fugit molestiae perferendis nulla dolorem.

Socials

instagram:

- url : https://instagram.com/hdonnelly

- username : hdonnelly

- bio : Non quidem impedit tenetur odit tenetur. Ullam ut et qui qui voluptates qui sit.

- followers : 5747

- following : 327

facebook:

- url : https://facebook.com/donnellyh

- username : donnellyh

- bio : Explicabo voluptas iure vel sapiente vitae omnis dolor.

- followers : 109

- following : 1276

tiktok:

- url : https://tiktok.com/@hertadonnelly

- username : hertadonnelly

- bio : Pariatur sequi nostrum voluptas quod et sapiente nostrum in.

- followers : 6087

- following : 947

twitter:

- url : https://twitter.com/hertadonnelly

- username : hertadonnelly

- bio : Sunt rem architecto vitae sit deserunt. Omnis quaerat incidunt rem reprehenderit molestiae aut illum.

- followers : 4888

- following : 2740